This article was originally published by WisdomTree on 11 September 2025. Written by Mobeen Tahir.

Belangrijkste opmerkingen

- Europe is rearming as defence spending, political coordination, and homegrown tech rise in pursuit of autonomy.

- Nuclear is making a comeback with small modular reactors (SMRs), large reactors, and AI-driven construction speeding deployment.

- Cybersecurity is now a geopolitical risk with rising investment as digital conflict intensifies.

- Critical minerals are becoming strategic as new supply chains form to reduce reliance on China.

- Blockchain is breaking through as stablecoins and tokenisation transform finance in a fracturing system.

In 20211, according to the World Economic Forum’s Global Risks Report, the world’s top risks were dominated by global challenges like climate change, the global pandemic, and biodiversity loss. In 20252, the focus has shifted to more immediate dangers like armed conflict, misinformation, and economic confrontation. Clearly, the risks most concerning people today reflect a more fragmented world.

For investors, fragmentation creates risks but also new areas of opportunity. This blog summarises the key messages from WisdomTree’s Thematic Outlook outlining five growth opportunities.

1. Europe’s pursuit of defence autonomy will accelerate as geopolitical trust erodes

Predictions:

- Defence tech champions will rise across Europe

- Political coordination will tighten around shared security goals

- Financial innovation will fund Europe’s defence investment surge

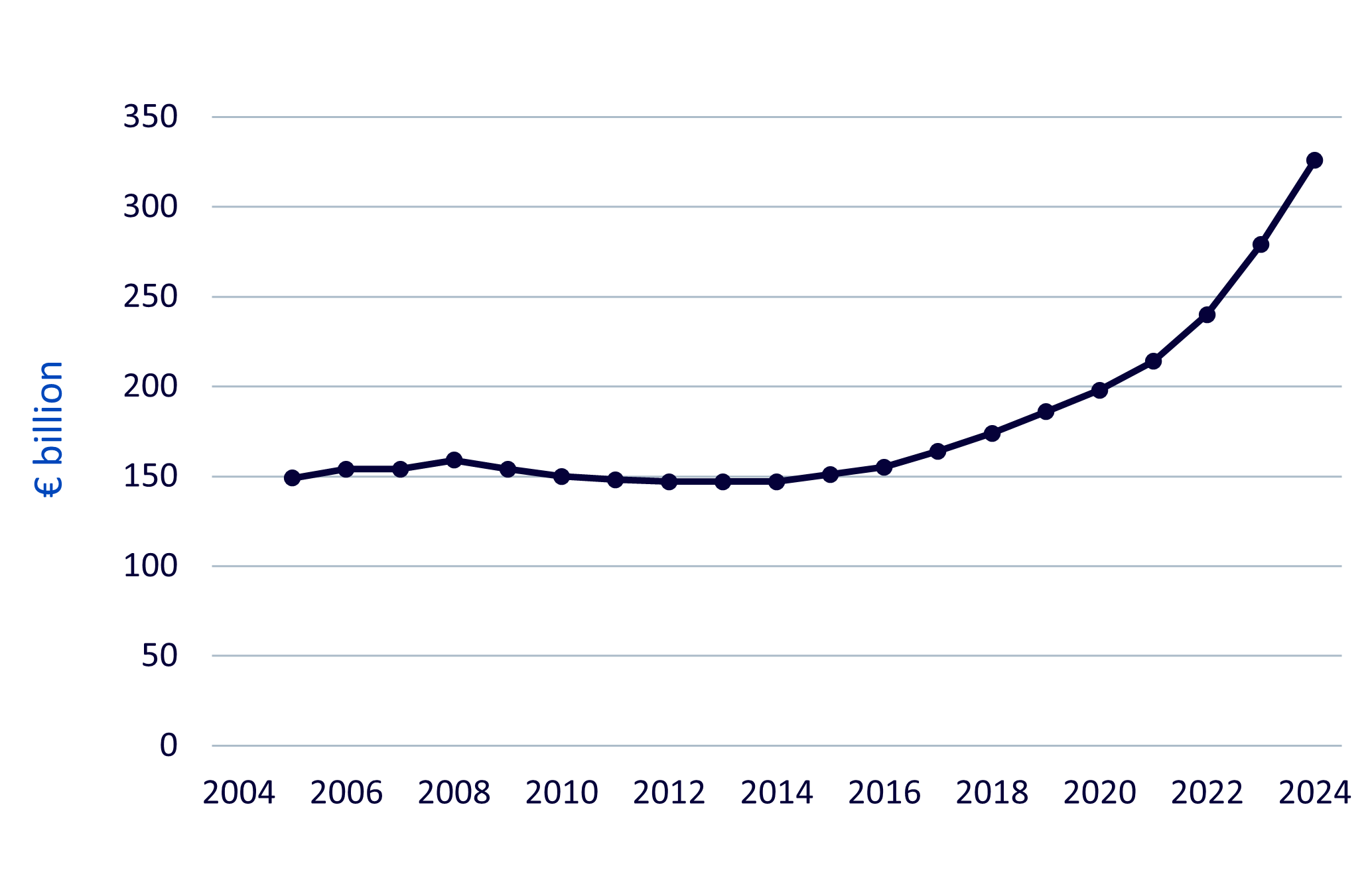

Figure 1: Defence spending by EU member states rose 30% between 2021 and 2024

Decades of underinvestment in defence and reliance on the US will take time to reverse. But strengthening defences and pursuing greater autonomy is no longer optional. European countries are responding by boosting defence spending, deepening political coordination, and developing homegrown defence technology.

Companies like Helsing, which recently demonstrated its autonomous software flying a Gripen fighter3, show how quickly European defence tech is advancing. Political deals such as the Kensington Treaty between Germany and the UK underline how shared security concerns are overcoming past friction. Meanwhile, NATO’s4 new target of 5% of GDP for defence spending by 2035 will require financial innovation. Europe may draw on its experience with Covid bonds to collectively fund its ambitious defence plans.

2. The global push for energy independence will further catalyse the ongoing nuclear energy renaissance

Predictions:

- Small modular reactors (SMRs) will be fast-tracked

- More large nuclear reactors will be reopened, extended, or announced

- More tech companies will jump on the nuclear bandwagon

Fragmentation in fossil fuel markets in a world with rapidly rising energy needs has given nuclear a new lease of life. From advanced reactors in the US to the UK’s selection of Rolls Royce’s SMR design, governments are moving quickly. Markets are watching closely as developers like Oklo promise deployment as early as 2027.

Large reactors are also returning. Meta and Microsoft have both struck long-term deals to support nuclear plants for their data centres, while France and the US are planning major capacity additions. China’s fivefold growth in nuclear over the past 15 years shows how this can be achieved. Other countries are taking note.

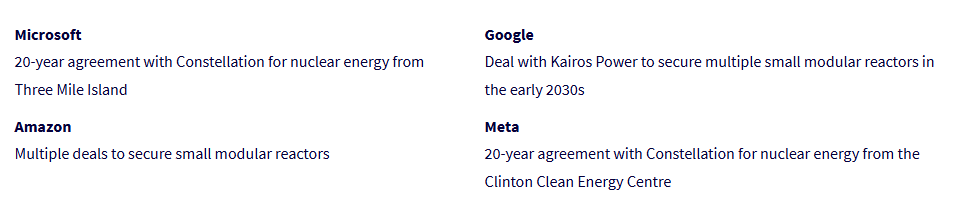

Figure 2: Big tech is making big bets on nuclear energy

Tech giants are racing to lock in nuclear energy for their data centres. At the same time, companies like Palantir are bringing AI into reactor construction to slash delays and cost overruns. Nuclear is fast becoming both a strategic and a tech story.

3. Rising digital conflict will fuel greater cybersecurity investment

Predictions:

- Cybersecurity will be recognised as a geopolitical risk, not just a technical one

- Global cybersecurity spending will rise as fragmentation raises risks

Cyberattacks are becoming a weapon of statecraft. The July attack on Microsoft’s SharePoint servers, which also hit the US nuclear weapons agency, showed how geopolitical conflict is spilling into the digital realm. NATO now includes cybersecurity in its expanded defence spending goals, and organisations are increasingly alert to threats from state-sponsored groups.

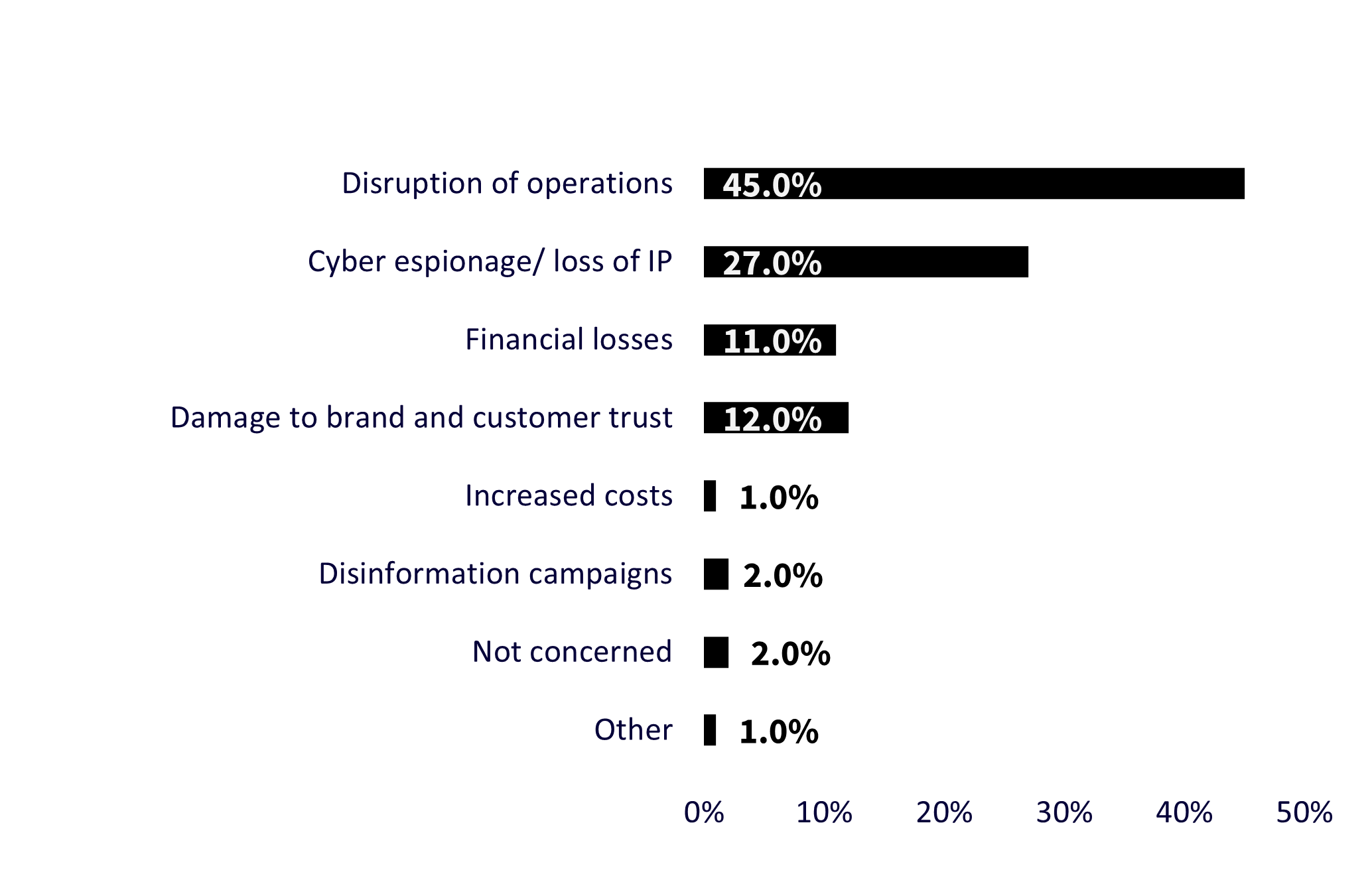

Figure 3: Biggest cybersecurity concerns for companies in the context of geopolitics

With the International Monetary Fund (IMF) warning that cybercrime could cost the world $23 trillion by 20275, the stakes are clear. A Team8 survey of Chief Information Security Officers shows that in 2025, despite budgetary constraints, more than half of organisations are raising their cybersecurity spending. Fragmentation has made cyber risk systemic, and the investment response is only likely to grow.

4. Critical minerals like rare earths will become more critical

Predictions:

- The US will be forced to reckon with China’s dominance

- Fragmentation will force new supply chains to open

Rare earth elements sit at the heart of military, clean energy, and digital technologies. China controls nearly 70% of mining and almost 90% of processing6, making them a strategic vulnerability for rivals. US companies are already pivoting away from Chinese supply, with Apple shifting to MP Materials, but refining capacity remains a bottleneck.

Countries are investing heavily to build alternative supply chains. Canada, Australia, and Japan are scaling up projects, and the US is leading the Minerals Security Partnership to build new supply chains. This is not just diversification but strategic realignment, and the coming years will likely see new supply networks emerge outside of China’s orbit.

5. Blockchain’s breakthrough will come in a fracturing financial world

Predictions:

- Stablecoins will become a key lever of US financial power

- Financial institutions will adopt blockchain to modernise infrastructure

The weaponisation of the financial system, from cutting Russia off SWIFT to growing BRICS alternatives, is challenging the US dollar’s dominance. In response, the US has moved to regulate and legitimise stablecoins, turning them into a potential tool of financial influence. Backed by Treasuries and cash-like assets, stablecoins can reinforce demand for the dollar while extending its reach into digital markets.

At the same time, tokenisation is scaling. Over $25 billion in assets are now live on blockchains7, with institutions embracing the efficiency of real-time settlement and lower transaction costs. In a fragmented world, blockchain adoption is becoming not just an economic choice, but a geopolitical one.

Conclusie

The risks that dominated global thinking in 2021 were about shared challenges like climate change and the global pandemic. By 2025, the conversation is shaped by conflict, polarisation, and fragmentation.

Yet fragmentation is also creating powerful investment themes. Europe is rearming, nuclear is resurging, cybersecurity is being securitised, supply chains for critical minerals are shifting, and blockchain is entering the financial mainstream. The tectonic shifts in global politics will inevitably move markets. These five themes could drive investor interest as that happens.

For WisdomTree’s full Market Outlook, please click here.

1World Economic Forum Global Risk Report 2021

2World Economic Forum Global Risk Report 2025

3FT, July 2025

4The North Atlantic Treaty Organization

5SentinelOne, International Monetary Fund (IMF), July 2025.

6Barrons, Jan 2025.

7RWA.xyz | Analytics on Tokenized Real-World Assets as of 21 July 2025

De informatie op mexem.com is uitsluitend bedoeld voor algemene informatiedoeleinden. Ze mag niet worden beschouwd als beleggingsadvies. Beleggen in aandelen houdt risico's in. De prestaties van een aandeel in het verleden zijn geen betrouwbare indicator voor de toekomstige prestaties. Raadpleeg altijd een financieel adviseur of betrouwbare bronnen voordat u beleggingsbeslissingen neemt.

Read the original article on WisdomTree.