close

PRIIPs

regulation

PRIIPs Regulation

The Packaged Retail and Insurance-based Investment Products Regulation - EU No1286/2014 (“PRIIPs Regulation” or “PRIIPs”) entered into force on 29 December 2014 and its requirements become applicable on 1 January 2018. The Regulation requires product manufacturers to create and maintain Key Information Documents (KIDs) and persons advising or selling PRIIPs to provide retail investors based in the European Economic Area(EEA) with KIDs to enable those investors to better understand and compare products.

The objectives of the PRIIPs Regulation.

Since the financial crisis of 2008, one of the main objectives of the European Commission has been to increase consumer protection and rebuild confidence in financial markets. The Regulation introduces a new standardized Key Information Document (KID) to improve the retail investor’s understanding of PRIIPs and the comparability of those products. APRIIP is defined as any investment where the amount repayable to the investor is subject to fluctuations because of exposure to reference values. In addition to insurance products, some examples of PRIIPs are options, futures, CFDs, structured products, etc.

The Regulation is an investor protection legislation, the main objectives are:

● To ensure the understanding and the comparability between similar products in order to help the investor make investment decisions.

● Improve transparency and increase confidence in the retail investment market.

● Promote a single European insurance market.

The Regulation aims to achieve these objectives by defining the standard format and content for the KID.

What is a KID?

The KID is a 3-page document that contains important details of the product including general description, cost, risk reward profile and possible performance scenarios.

Who is the regulation applicable to?

The Regulation applies to both PRIIPs manufacturers and distributors. The responsibility to create and maintain the document falls to the product manufacturer. However, any distributor or financial intermediary that sells or provides advice about PRIIPs to a retail investor, or receives a buy order for a PRIIP from a retail investor, must provide the investor with a KID. This also applies to execution-only, online environments.

Who should receive a KID?

Retail investors domiciled in the EEA should receive a KID prior to investing in a PRIIP. If no KID is available from the manufacturer, the PRIIP will be restricted from trading for EEA retail customers.

Implications for Interactive Brokers:

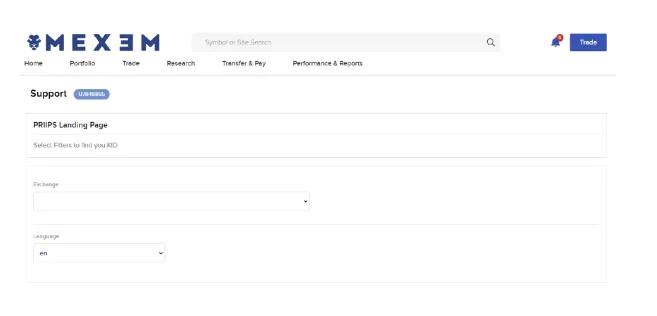

In order to meet the PRIIPs Regulation, where required, IB UK will provide KIDs electronically by means of a website (“PRIIPs KID Landing Page”).

Where can I find the PRIIPs KID Landing Page?

The KIDs can be accessed from our designated PRIIPs KID Landing Page. There are three different ways you can find the KIDs. They are available through the IBKR TraderWorkstation (“TWS”), the IBKR website and Client Portal.

1. Find KIDs through TWS:

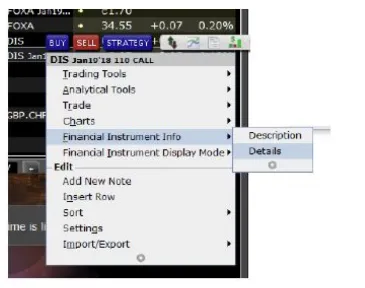

● Log into TWS

● Right click on the symbol of the product for which you want the KID.

● Under Financial Instrument Info select Details.

● From the Contract Details page, you can select the PRIIPs KID link. This will take you to our PRIIPs KID Landing Page in Client Portal.

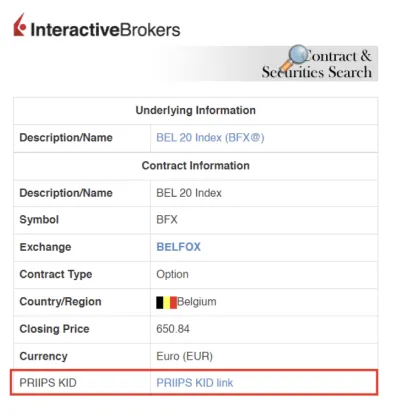

2. Find KIDs through the Interactive Brokers website:

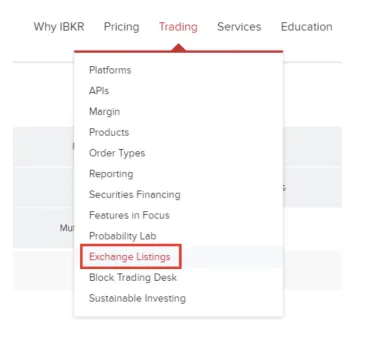

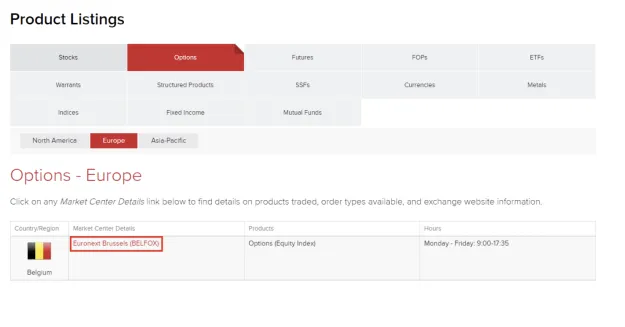

● Open the Trading tab and select Exchange Listings.

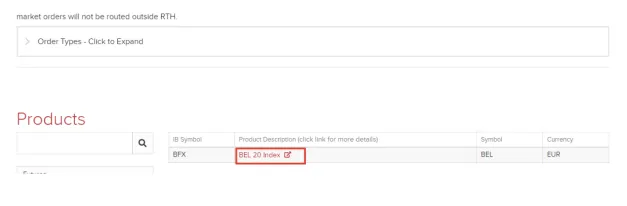

● From there, select Product Listings. Select the derivative type, region and exchange of the product for which you would like to find the contract information.

● Select the product you would like to see the KID of, which will take you to the Contract Details page.

● From the Contract Details page, as above, you can select the PRIIPs KID link, which will take you to our PRIIPs KID Landing Page in Client Portal.

3. Find KIDs through Client Portal:

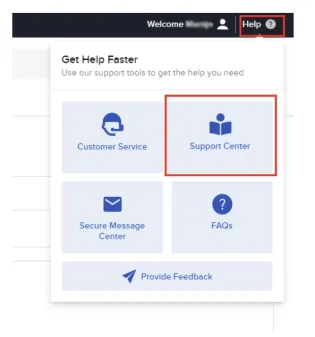

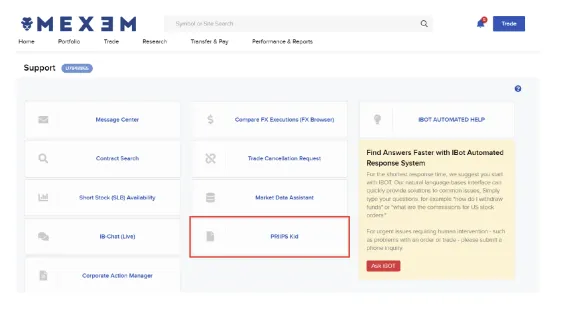

● Log into Client Portal.

● Click the Help (?) icon followed by Support Center.

● In the Information & Tools section, select PRIIPs Kid, which will take you to our PRIIPs KID Landing Page

Klaar om te beginnen?

Beleg met vertrouwen door middel van regelgeving die onze klanten op hun gemak stelt en tegelijkertijd risico's beperkt.

All investments involve risks, including the possible loss of capital.

www.mexem.com is a website owned and operated by MEXEM Ltd. MEXEM Ltd is a European broker regulated by CySEC, license No. 325/17.

Read our Terms & Conditions.

Read our Forms & Disclosures.

Any advertisement or communication concerning the distribution of derivatives falling within the scope of the Regulation of the FSMA of 26 May 2016 governing the distribution of certain derivative financial instruments to retail clients is not addressed to the Belgian public.